In this edition:

- Immigration New Zealand: significant processing delays

- Global financial turbulance? Not in New Zealand

- Investing in the New Zealand primary sector

- Lowest unemployment in ten years

Immigration New Zealand: significant processing delays

If you’re planning on applying for a visa you should be aware that Immigration New Zealand (INZ) has been experiencing significant delays in the processing of all visa categories lately. INZ has advised that the delays are mainly due to the increased volume of visa applications received both onshore and offshore.

Once your application has been submitted to INZ for processing, the first step is for it to be ‘vetted’ and assessed to see if all relevant documents and information are included, and all lodgement requirements are met. Provided your application is accepted for lodgement, it will then join a queue to be allocated to a case officer for processing. The delays currently being experienced tend to be at the allocation stage where the visa application will sit in a queue for number of weeks or months waiting to be allocated to an Immigration Officer for assessment.

Current (approximate) processing timeframes are as follows:

Essential Skills Work Visa: up to three months

Work to Residence (Talent) Work Visa: up to 69 days

Work Visa (Partnership): up to four months

Student Visa: up to four months

Visitor Visa: up to 24 days

Skilled Migrant Category Residence Application: up to 13 months

Residence Application (Partnership): up to nine months

In our recent experience, there have been longer delays for applicants applying from offshore. However, there has also been some inconsistency in visa processing timeframes in general, so some applications are processed in two-to-three weeks (which is apparently random).

We understand INZ is attempting to manage the increased volume of visa applications received by arranging additional shifts for its staff members, including weekend shifts.

Our advice to employers and applicants is to begin preparing visa applications well in advance of the intended date of travel and/or expiry of current temporary visas.

Limitations of Interim visas

Getting your visa application lodged early is particularly important if you are in New Zealand on a visa with an upcoming visa expiry date.

If a new visa application has not been processed by the time the visa expiry date arrives, an interim visa should be issued by INZ. The interim visa allows you to remain in New Zealand lawfully whilst awaiting a decision on their new visa application. However, it is very important to note carefully the conditions of the interim visa. The current visa type the you hold and the visa type that you have applied for will determine the interim visa conditions.

In most cases where the visa being applied for is different to the visa the applicant previously held, the interim visa will revert to visitor conditions.

Visitor conditions do not allow the visa holder to undertake employment, meaning applicants will need to stop work until their new visa is issued.

Common examples include:

| Current visa | Applying for | Interim conditions |

| Working Holiday | Essential Skills | Visitor |

| Essential Skills | Talent – Work to Residence | Visitor |

| Essential Skills | Essential Skills (new role) | Visitor |

| Post Study Open Work | Essential Skills | Visitor |

Understandably, the inability for you to work is likely to have a significant negative impact on both the you and your employer.

Interim visas also have no travel conditions, meaning if you wish to travel out of NZ you will not be able to re-enter on the interim visa, but must wait until the new visa has been issued.

If you, or someone you know, requires assistance in preparing an application in light of the above information, the Lane Neave Workplace law team would be happy to assist.

Please contact Lane Neave Lawyers on + 64 3 379 3720

Global financial turbulance? Not in New Zealand

When the world goes through a period of financial turbulence with falling share prices, recessionary economies, easing monetary policies and rising unemployment, a number of things normally happen. Investors tend to flock to assets such as government bonds, young people move back home, currencies viewed as safe havens, such as the Japanese Yen, go up, and many businesses of course close down.

In New Zealand we get hit by a declining world economy through lower export prices, high pessimism, and businesses and consumers reacting to what they see offshore by cutting their spending. But we also have some strong insulating factors which mute the economic impact. One of these we share with all economies – lower interest rates as our central bank seeks to cushion the downturn.

Another we share with smaller, usually commodity-dependent countries. The NZ dollar tends to fall away sharply. This eventually sets the scene for an export-led recovery. But the third insulating factor is something very few other economies enjoy.

When times get bad around the world our net migration numbers seem to pick up. Some of the one million Kiwis living overseas come back home as they lose their jobs or see their dreams of building a nest egg evaporate. Those amongst the five million living in New Zealand who were going to shift offshore put their relocation plans on hold.

That is, our economy can get insulated from a global downturn with a small acceleration in population growth. We can see this when the last global downturn occurred over 2008-09. Over 2008, before things became very bad offshore, the net migration inflow into New Zealand was a gain of 14,000. By the end of 2009 this had risen to a gain of 21,000. But then, as things improved overseas the net gain fell away to just 5,000 over 2010.

The effect is not big and when we look at the data for inflows and outflows, we can see that the driver of the change in flows is driven by people staying put in New Zealand.

What this means for potential migrants is this. If things around the world do go bad and the poor economic data in the likes of the UK, Italy, Germany, and China continue and get worsened by factors such as Brexit, Hong Kong, and events elsewhere, then in the year following the downturn employers in New Zealand will more easily be able to meet their staff needs from locals rather than sourcing offshore.

But once the global recovery starts up, Kiwis will head offshore again fairly quickly and the difficulties companies are currently having finding skilled and even unskilled staff, will return very quickly.

So, is the world heading toward recession? New Zealand certainly isn’t with many sectors showing strong underlying growth, supported by record low interest rates, a relatively low NZ dollar, good export prices, rising government spending, and long-term growth in sectors like healthcare and the digital economy. But offshore, factors which could trigger a recession are numerous, as noted above.

History tells us that by and large a global downturn comes as a shock, rather than something comfortably predicted. If you think global recession is coming and you were planning a shift to New Zealand you might want to exercise some caution. But if you think the world economy will get by with just a mild slowing in growth, then by all means continue to consider New Zealand.

In fact, keep in mind that although any global downturn will hit demand for migrant labour in NZ, the extent of labour shortages may be so great that businesses will pull back on their offshore hiring far less than has happened in the past. Or perhaps, the period of pullback may be relatively short-lived and only a short delaying of relocation down here would be required.

Article provided by Tony Alexander – Chief Economist, Strategy & Business Performance, BNZ.

Investing in the New Zealand primary sector

New Zealand is famous for its primary sector products around the world. The primary sector includes agriculture, horticulture/viticulture, seafood/aquaculture and related services. It’s no surprise that investors are interested in gaining investment exposure to this sector.

The share market may be the easiest option to invest. The benefits of investing through the share market for migrants and overseas investors comparing to other forms of investments are:

- Easy to achieve a relatively diversified exposure within the sector.

- High governance and transparent requirements imposed by the stock exchange comparing to private investments.

- Market liquidity that private investment is hard to achieve

- Majority of companies are export oriented with Asia as one of the major destinations, in other words, the investment would also be an indirect exposure to Asia’s growing middle class economy.

- Portfolio investors generally do not trigger overseas investment office approval process .

- Qualify for Immigration NZ acceptable active investment for investor visa purpose.

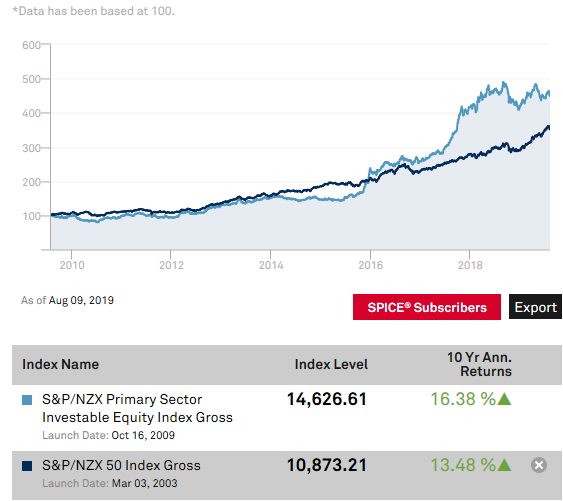

The overall performance of the sector for the last 10 years was good with returns of 16.38%p.a., as seen in Chart 1. The key contributor to the outperformance from 2016 was the rise of the A2 milk company. A2 has the technology of identifying cows that produce A2 protein milk. They contract farmers to produce A2 milk, contract dairy processors to make them into mainly infant formula and export. The A2 products are popular in Australia and China. A2’s market capitalisation has increased by more than 10-fold in the last three years. The key risk of A2 is too much reliance in the Chinese market.

Primary sector performance would be very volatile. Companies tend to be small in size in internal standard and only focus on one subsector, such as dairy, wine, fruit etc. Admittedly weather may be the risk factor that you have to accept when investing in this sector. Weather would affect companies’ performances across the sector. In the last 12-18mths, a number of companies’ performance was affected by adverse weather.

The key to investing in the sector is to diversify. To invest in a diversified portfolio across the sector can help to mitigate several other risk factors, such as individual company operational risk and consumer preference changes. For example, horticulture/viticulture produces have gained increased popularity in recent years around the world.

While listed share investment are considered a liquid investment, several primary produce companies are quite small. Liquidity would be an issue for large investors. Its very important for investors to conduct due diligence before investing and make sure your investment plans are suitable for your personal requirements.

Chart 1: Performance in the past 10 years

*Source: S&P Dow Jones Indices

Article provided by Ally Cui – Director, JB Were.

Lowest unemployment in ten years

What a difference a month makes in recruitment and business generally. Quarterly statistics have been released which now suggest we have the lowest unemployment in ten years (www.interest.co.nz /unemployment rate) after previously hearing reports that this rate was climbing toward record highs.

This coupled with the bad news of Fonterra‘s poor performance (www.nz herald.co.nz / fonterra performance) suggested we were sliding toward further economic gloom in New Zealand.

Countering this has been the release of further funding from the Regional NZ growth fund (https://www.tvnz.co.nz/ regionalgrowthfund).

This boost to regional economies, along with the traditional spring uplift in business, has resulted in a more optimistic outlook toward economic growth.

Enterprise Recruitment have over fourty years experience in the New Zealand market place and have strong networks throughout the country.

We offer a complimentary CV review and feedback on your employability in New Zealand.

We can be contacted via Steve Baker on 00 64 27 2125483 or steve.baker@enterprise.co.nz.

DIY Work Visa workshops

Come to our “DIY Work Visa” Workshop to find out all you need to know to make a successful application without the requirement for a full immigration service.

Wellington – Tuesday 3 September 2019

Queenstown – Wednesday, 11 September 2019